I love the smell of eCommerce in May

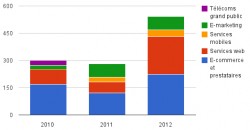

Investment is growing – International Investors getting curious

As we mentioned, a 93% growth in investment for France looks good, especially when we see that it is international investors making up some of the difference. The report notes that between Fotolia, Criteo, and Deezer alone, international investors put in nearly 250 million euros. In addition, foreign funds like Index & Accel have been up-ing their game this past year – despite Business Objects founder Bernard Liautaud making regular trips to Paris in the form of open office hours, France saw little to no investment from Balderton Capital, the fund where he is a partner.

What does 2013 hold?

Hopefully France will continue to see more foreign investment. I know this may make many VCs unhappy, as it will push up valuations on startups in earlier & earlier stages, but Rude Baguette will be working very hard in 2013 to create more cohesion between international investors and the French ecosystem. There is a great new generation of startups that I’ve seen brewing these past few months, and I’m looking forward to watching them continue to grow in an ever-growing ecosystem.

Did you like it? 4.5/5 (23)