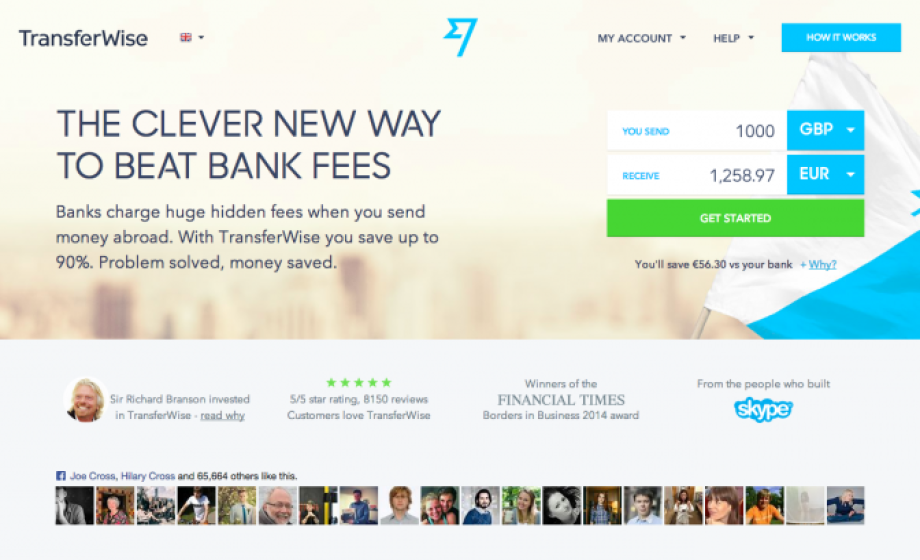

After having raised $33 million from investors such as Richard Branson, Peter Thiel, Max Levchin, and Xavier Niel, hitting the £1bn in transaction volume milestone, and saving customers a whopping £45 million in banking fees, TransferWise has announced today various new functionality and features to put them squarely on the path to challenging the big banks for mainstream customers. Some of the big changes include:

- A website redesign, including a streamlined and more intuitive user experience which ‘onboards’ customers twice as fast as before.

- A new visual identity and logo – ‘The Fast Flag’ – to create a sharp contrast with traditional banks and money transfer brokers.

- iOS 8 app for iPhone 6 and 6+ and iPad, featuring total redesign, touch-ID login and deep integration with the iPhone contacts book.

- Its first primetime TV advert to air nationally in the UK from today.

In speaking about today’s news, Taavet Hinrikus, co-founder of TransferWise adds:

“The retail banking industry in Europe is dominated by a handful of major players. This poses a huge challenge for fintech companies like us, looking to attract consumers who’ve grown up with the same few brand names. We believe that just being a little better isn’t enough, so we strive to offer something that’s ten times easier, faster and better than the banks to make mainstream consumers aware of alternative finance providers like us. That’s why we’ve invested in the new product and brand we’re launching today.”

Started in 2011 in London by Skype’s first employee Taavet Hinrikus and friend Kristo Käärmann, TransferWise’s principal mission hs been to shake-up the currency exchange market, largely the realm of big banks, by allowing people to transfer money abroad at a lower cost than ever before. While exchanges initially were limited to euro-pound transactions, they now support nearly 20 currencies including such currencies as the Turkish lira, Hungarian forint, US Dollar, and the Danish, Swedish, Czech, Norwegian krone. While the idea of dramatically reducing transfer fees appeals to many, TransferWise is obviously most popular with expats, freelancers, retirees who’ve retired abroad, and SMEs.

They’ve been steadily expanding their footprint outside the UK and France, in particular, is an important market for them. In speaking about the French market, Hinrikus adds:

“France is a huge market for us – it has over a million expats in Paris alone. Not to mention, the holidaymakers with properties in the South of France. All of these guys need to move money across borders on a regular basis. We want to save them from the hidden fees they’ll be stung with if they send this money through their high street bank.”