The following article is a guest post by Yann Lechelle, co-founder of Appsfire, a growth engine for mobile apps. A French version of the article is available on the French digital daily Viuz.com

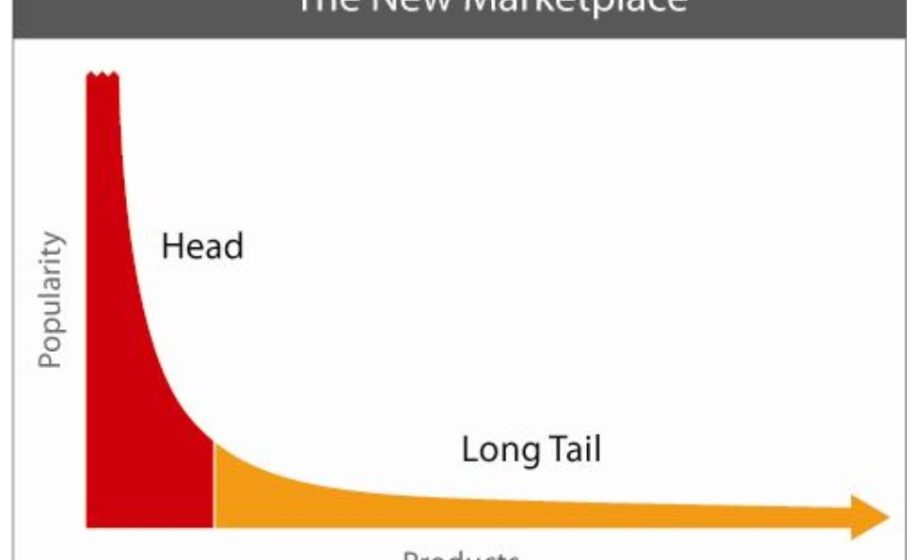

Before we tackle this controversy, we should go back to the meaning of the Long-Tail Effect as referred to by Chris Anderson in an October 2004 article of the magazine Wired. The Long Tail concept is illustrated by the right part of the graph below, in orange. This graph maps the formula at the heart of Pareto’s law (named after the economist Vilfredo Pareto), which describes a typical 80/20 relationship within social and economic context; e.g. 80% of sales would come from only 20% of the products and vice-versa.

Chris Anderson correctly analysed that the advent of e-commerce sites like Amazon or iTunes gave more prominence to the bottom of the catalogue than ever, therefore making it possible to increase the sales of historically less popular items which in a classical trade model had no chance of being on front display (or even in stock!) nor of having enough success to benefit from the accelerator effect of those at the top of the pile (the top 50 chart in music for example). Therefore, thanks to new e-commerce sites, the right side of the graph representing less popular items pushes up to reap greater distribution benefits (graph below).

App Stores are a clear emanation of these e-commerce sites, starting with the iTunes App Store (July 2008), which itself was directly derived from the iTunes Music Store created a few years earlier to feed the iPod: a catalogue with similar meta-data attributes (a title, image, description), identical type of median pricing for items (one track = one app = $0.99), downloading of items and, perhaps not for the best, the same consumer interface (the iTunes desktop application on Mac or PC).

While the iTunes App Store is over 5 years old and the number of catalogue references exceeds a million items as many as the Google Play Store for Android, it is legitimate to ask oneself whether the long tail applies to these pure e-commerce sites, next generation offsprings with only slight mutations… Does an app buried away at the bottom of the catalogue benefit from the positive effects mentioned above? Do the app stores facilitate the discovery of apps and allow app publishers and developers to establish a truly profitable business?

Unfortunately, current analysis highlights a number of phenomena which refute the positive effect of the long tail.

Non-recurrence on each vertical

Unlike in music where you buy the umpteenth track or album of your favorite singer or favorite type of music, buying yet another personal management application, calendar or weather app makes little sense (except perhaps in certain games categories). In reality, pure content (literature, music, videos, games) all have an advantage which does not exist in the world of apps which tend to freeze consumption of comparable items (network effect, winner takes all).

Quasi-monopoly on Distribution

Whereas in e-commerce there is natural competition between sites themselves, including between the actual brick-and-mortar stores, app stores have an almost total monopoly as they come preinstalled and integrated with the mobile operating system (except for jailbreak mode on iOS, or in China with its 80+ number of alternative Android app stores).

Anti-competitive

While on Amazon or iTunes, you cannot find any book by the author “Amazon Inc.” or any album by the band “Apple Inc.”, on the Mac App Store, you find in the end that the best sellers are actual software edited by the fruit company itself ! The same remains true on the iTunes App Store and the Google Play Store since a number of leading and mainstream applications published by the platform itself dominate the listings (iOS: keynote, pages, numbers; Android: Gmail, maps, etc.). Bearing in mind that the top 10 fills up quickly, there is very little room left for outsiders!

Popularity ≠ Revenue

While in classic e-commerce, each item is paid for and therefore generates revenue, in the App Store, most applications are free (with a payment model to be developed later via in-app purchase, advertisement, etc.). An increase in the volumetry therefore does not implicitly have direct repercussions on the revenue, since a certain usage threshold is necessary before monetization becomes relevant.

The Power of Featuring

E-commerce sites, and app stores too, display items in two ways: an editorial display categorized by humans (human curation) as well as category-based listings sorted in near real-time by algorithms (charts, top 10, etc.). The app store is the unavoidable toll in the consumption of free and paid-for applications and even updates (iOS 7 changes things by offering the possibility for automatic background updates). Each visit to the app store therefore influences the visitor through its editorial featuring. The top 10 is never far away, and acts as an immediate amplifier to a captive, global and very broad audience (several hundreds of millions). The impact of being featured can propel an app, and this effect is still today very much in demand. At the beginning of 2012 we demonstrated that only 0.05% of all applications had the privilege of being in the top 25 in a given month.

Manipulation of listings

With regard to app store featuring, it is possible to imagine that manipulation, privileges or partnership with the editorial team improves your chances. In reality, I like to believe that this effect is minor or inexistant, since meritocracy is key. With algorithms, however, things get complicated. On the one hand, if popularity is based on volume (which is the case with the charts), it is very difficult to influence this popularity listing if the items must be paid for. Yet, as explained earlier, since the majority of apps in the app stores are free to download, some black-hat players have managed to create or benefit from tricks allowing to strongly influence these listings (mass incentivized downloads or mass bot-farm downloads in Russia or China). This simple possibility rules out almost single-handedly a hypothetical long-tail effect.

These arguments alone suggest that the long-tail effect probably does not hold water on the app stores. This situation is even exacerbated, since if there is no long-tail effect, the opposite becomes possible: the creation of super champions capitalizing on the nature of apps which have built-in sharing and viral features that books or films do not have! Take the games Angry Birds or Candy Crush for example, or even Instagram, SnapChat or Whatsapp. At a lower budget, the leverage obtained by these apps is unmatched in the world of physical goods distributed by Amazon! Each game of Candy Crush or a Whatsapp exchange contributes to crushing this long-tail effect and hindering those publishers who are much smaller.

Flurry mentioned in mid-2012 that app stores offered a kind of long tail, or in any case a boost in the distribution of long-tail revenues (68% of revenue for apps classified below 100th position in 2012 against 45% in 2010). The truth of this article is that its long-tail claim only covered paid and freemium apps. In total, excluding advertising revenue and including free applications, the equation is turned on its head and the distribution for the entire catalogue looks like a more severe version of the Pareto law… in a reply on Quora I put forward the (probably false) theory that only 2% of the iTunes App Store apps (i.e. 20,000) generated over $100,000 revenue per year. The reality for most is harsh, as a number of developers will testify.

Apple has not only reinvented the modern smartphone, but also with it, a way of conceiving and distributing software. Apple has certainly unleashed a new economic model and triggered a real value‑generating market. It is still necessary to apprehend the figures released by Apple with cynicism:

- Over 15 billion dollars redistributed to hundreds of thousands of developers over nearly 6 years. To put it simply, this represents an optimistic average of $10,000 per year for each developer — far from a decent wage — and that is if the team has only one employee! (fortunately, there are still advertising models for earning money differently!)

- Over 50 billion downloads: it is good to mention that these are one-off downloads and exclude upgrades; in reality, are these applications used? How many are used daily and how many are uninstalled? The figures hide a harsher reality still. In 2014, using download figures is not longer a proper KPI, at best, it’s a vanity metric…

One thing is certain: app stores are far from perfect, but they contribute enormously to the success of the platform itself and the sales of smartphone devices. The swarms of developers won over generally get very little except for the illusion of being able to create a “hit” (the bar is very high, and yet seems attainable).

In this post last year, Benedict Evans argued that app stores are fundamentally not so different from Yahoo circa 1996, that is, a very primitive catalogue limited by its own success and the quantity of referenced items. Should the app stores therefore wait for their new discovery paradigm, the equivalent of the search engines which replaced the Yahoo model? It is also this observation that led my co-founder and I to create Appsfire n 2009 to complement the App Store’s typical monolithic discovery experience by innovating first and foremost through active and social discovery, and then by proposing passive and more recently advertising discovery models (the focus of our attention today).

We have often suggested that Apple in particular, but also others, should simply get rid of the rankings (we are not alone in thinking this either). We certainly have a large number of ideas on how the future of active and passive discovery could pan out; but only the platforms themselves have the power to open the floodgates and reinvent a better form of distribution of these modern items, the smartphone apps.

In the meantime, the only leverage available to app publishers to promote their apps sitting at the bottom of the catalogue are quite external to the stores themselves (and consequently, if there was long tail in the app economy, it would not be due to the app stores alone):

- word-of-mouth and viral effect (difficult to master and not applicable to all applications).

- conventional search engine keyword optimisation for better discovery via Google, Bing, etc. ; unfortunately, there are few new discoveries by keywords only as most typed searches are for known titles.

- through inter-application advertisement (e.g. Facebook, which advertises third-party applications on their very timeline, or via app install native ad networks like Appsfire).

- traditional banners applied to mobile web (e.g. adMob).

- traditional offline adverts such as paper, TV or radio advert breaks, which it at the moment is tapped into very little.

All this being said, Apple and Google are not sitting idle when it comes to the above mentioned topics; both firms will lead us to believe that they are in fact fully focused to solve the matter. For example, iAd is an Apple entity that offers app install banner ads (but not just) within applications. In the same way, Google (already more at home with the idea of advertisement as it is Google’s core business) offers adMob for promoting applications (but not just) within applications, or more traditionally on mobile sites. That being said, these two behemoths cannot roll out a paid distribution model (collecting 30% from app store transactions and in-app purchases) and at the same time dominate the advertising model – that would end up influencing their own listings and may affect their much needed neutrality as store owners!

During the Apple Worldwide Developers’ Conference (WWDC) in San Francisco in June 2013, the Apple iAd team also explained either through naivety or arrogance, that the only two ways for an application to be discovered were…via the App Store or iAd! No matter how shocking, these revelations tell us something more profound: that app stores alone the app store do not offer the benefits of long tail and consequently should not be considered as the only route for discovery, far from it! All other resources have to be carefully harnessed, including, and in particular, marketing via re-engagement and advertising, when fully aware of acquisition costs that is. At Appsfire these topics fuel our day-to-day as we strive to find solutions for advertising, engagement and monetization for all publishers so as to maximise their chances of commercial success.

In conclusion, App Stores are probably anti long tail. Extreme polarization is very real and every chance has to be seized upon to get out of the long tail and get to the the front. A few recommendations therefore: learn all of the 3 letter acronyms that start with a C professionalize the entire conversion funnel from impression to install to engagement. Think of the economic model from the outset, whether it is through advertising, paid application model or freemium. Find out the average revenue per user [ARPU] or average lifetime value [LTV]. This discipline allows you very soon to find out the reasonable price for acquiring committed users (which hopefully should be lower than the ARPU/LTV!). Finding out the usage patterns of these new users requires complete traceability from start to finish (service providers should therefore be requested to supply clear and transparent reports). By having control of your funnel, it is easier to develop better user acquisition strategies and therefore grow more quickly and strongly, and emerge from the shallow long tail…

Finally a few tips always to bear in mind: in an ever more competitive world, you have to find a way to gain a competitive advantage or be diffentiated, whether by adopting a brand new technology, or in terms of design and user experience, by being radically simpler or far more sophisticated than others. And of course, aim for a much broader market, preferably a global one – that aspect of multilingual and global distribution is one of the rare added values you will find on the app stores.